Bitcoin achieved five new all-time high prices this week, boosted by a wave of renewed optimism and growing confidence in the future of the cryptocurrency.

Meanwhile, MicroStrategy (NASDAQ:MSTR) increased its Bitcoin holdings, sending its stock price to record-high valuations, and a major development in Google’s (NASDAQ:GOOGL) anti-trust trial weighed heavily on investors.

1. Bitcoin nears US$100,000, Solana, XRP soar

This week proved to be another dynamic period in the digital asset market. The industry witnessed multiple new all-time highs and regulatory developments, with the total crypto market cap reaching a record-breaking US$3.025 trillion on Monday. The Crypto Fear and Greed Index also hit its highest level since March, a sign that market sentiment is becoming increasingly bullish.

After the US Federal Reserve dampened expectations last week of further interest rate cuts when it meets in December, Bitcoin’s volatility score reached a high of 3.34 on Monday, according to TradingView data, while its price fluctuated between US$89,000 and US$93,800 at the start of the week.

Tuesday’s debut of BlackRock’s Bitcoin ETF (NASDAQ:IBIT) options drove Bitcoin’s value up by over 2 percent as nearly US$2 billion poured into the newly approved funds on their first day. The ratio of call options to put options was 4.4 to 1, indicating more bets on Bitcoin’s price increasing than decreasing.

On Wednesday, Bitcoin broke US$94,000 for the first time in history in pre-market trading, marking the first of five new all-time highs this week.

The rally continued after Bloomberg News reported that Trump’s team was holding discussions with the digital asset industry about whether to create a new White House post solely dedicated to crypto policy. This lead to its next record high of US$97,000 just after midnight EST on Thursday (November 21), followed by an ascent to US$98,310 early on Thursday morning.

It pulled back slightly as trading commenced, then surged to US$99,500 following the news, reported by Reuters around 2:30 p.m. EST on Thursday, that US Securities and Exchange Commission Chairman Gary Gensler would be leaving his position on January 20.

Bitcoin’s opening price on Friday was US$97,915 and it notched its final all-time high price of US$99,645 at around 2:30 p.m. EST. It closed the week with a valuation of around US$99,300 following reports that Trump’s social media company filed for a trademark with the United States Patent and Trademark Office for computer software for use as a digital wallet, payment processing for crypto, fiat and trading in digital assets.

In other crypto news, the biggest gainer was Solana emerged as a significant mover, with its price increasing by 20.2 percent week-over-week to reach US$253.70 on Friday. The cryptocurrency, which outpaced Ethereum in terms of decentralized exchange (DEX) volume this week, hit a record-high valuation of US$262.46 on Thursday.

This substantial change was driven by Bitwise’s registration of a Bitwise Solana ETF on Thursday, indicating the company’s intent to launch a spot Solana ETF. This makes Bitwise the latest institution to file for a Solana spot ETF. Previously, VanEck filed with the SEC for a spot Solana ETF on June 27, 21Shares submitted its Solana ETF application on June 28 and Canary Capital filed on October 30.

By the time the trading day closed Friday, XRP had climbed 33 percent this week to a new all-time high of US$1.48 on Friday morning. Open interest for XRP derivatives also surpassed US$2 billion on Sunday (November 17). Ethereum was also up this week, moving up 8.4 percent for the week to US$3,293.28.

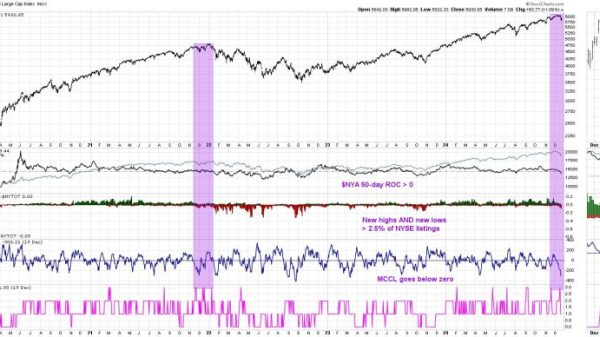

Bitcoin price chart, November 16, 2024, to November 22, 2024.

Chart provided by CoinGecko

2. MicroStrategy scoops up more Bitcoin

MicroStrategy’s Bitcoin buying spree continued this week as the company announced a private offering of US$1.75 billion of convertible senior notes on Monday. In the press release, the company shared its intention to use the proceeds of the sale to purchase more Bitcoin and for general corporate purposes.

On Tuesday, amidst a Bitcoin rally, MicroStrategy’s options open interest exceeded market capitalization, and the stock’s trading volume was comparable to that of Apple and Microsoft. Its share price closed at a record US$430, 24.79 percent above the previous day’s opening price of US$345.15.

On Wednesday, MicroStrategy made the top 100 US publicly traded companies by market capitalization. Boosted by the surging price of Bitcoin, the company increased its offering to US$2.6 billion. Chairman Michael Saylor also said would be presenting a brief pitch to Microsoft’s (NASDAQ:MSFT) board of directors to encourage the company to include Bitcoin in its investment portfolio.

On Thursday MicroStrategy’s share price jumped to US$535.74. However, its week’s gains were reversed after Citron Research said the firm was shorting the software company. “Much respect to @saylor, but even he must know $MSTR is overheated,” the firm tweeted as the markets opened.

Later that day, MicroStrategy announced it had completed its offering, worth US$3 billion, but it wasn’t enough to sway investors. The company’s share price ultimately closed the day at US$397.28, down 25.84 percent from the start of trading, marking its worst single-day loss since April 30.

The company’s share price ultimately ended the week up 22 percent overall after recovering slightly during Friday’s session, which it closed at US$421.88.

3. Judge rules Alphabet must divest its Chrome business

In a court filing released on Thursday morning, antitrust enforcers ordered Google’s parent company, Alphabet, to sell its Chrome browser. According to Bloomberg Intelligence analyst Mandeep Singh, the business could go for as much as US$20 billion.

Alphabet’s share price slid 4.7 percent to a four-week low as markets wrapped on Thursday. It dropped a further 0.38 percent after hours.

This is the latest development in the antitrust lawsuit filed against Alphabet in 2020. In August 2024, following a trial that began in September 2023, a judge ruled that Google’s practice of paying billions of dollars to maintain its position as the default search engine was an illegal monopolization of the search market.

Google will have an opportunity to submit its own views on the matter next month. In a statement, Kent Walker, President of Global Affairs for Google and Alphabet, said, “DOJ’s approach would result in unprecedented government overreach that would harm American consumers, developers, and small businesses — and jeopardize America’s global economic and technological leadership at precisely the moment it’s needed most.”

The Justice Department will also offer additional perspectives in March 2025 before a two-week hearing scheduled for April. However, when President-elect Donald Trump takes office in January, his administration could opt to discard or make changes to the injunction.

In the court filing, the plaintiffs also proposed that Google be prohibited from acquiring, investing in or partnering with any company that influences consumer search behavior, including AI-powered search products.

Sources suggest this provision is aimed at Google’s investment in Anthropic. If the judge accepts the proposal, Google will be forced to unwind a partnership with Anthropic, which was struck in 2022 and made Google Cloud Anthropic’s primary cloud provider.

The two companies are also collaborating to develop AI systems. Google’s investments in Anthropic have been a significant source of funding for Anthropic’s research and development efforts. The deal was subject to regulatory scrutiny in the United Kingdom; however, the Competitions and Markets Authority, the UK’s primary competition regulatory, ultimately decided not to pursue an investigation on Thursday.

Enforcers also recommended the divestiture of the company’s Android operating system in the case that the ‘proposed conduct remedies are not effective in preventing Google from improperly leveraging its control of the Android ecosystem to its advantage, or if Google attempts to circumvent the remedy package.’

Google ended the week with its share price down 4.79 percent for the week at a valuation of US$166.57.

Chart showing Alphabet’s share price performance, November 18, 2024, to November 22, 2024.

Chart via Google Finance.

4. Sky-high expectations dampen Nvidia’s Q3 earnings report

Nvidia’s (NASDAQ:NVDA) share price experienced a turbulent week, starting with a 1.3 percent decline on Monday following a report in the Information alleging that the company’s new Blackwell graphics processing units (GPUs) were overheating servers. Sources claimed that Nvidia had asked suppliers to redesign the server racks due to this issue late in the production process, but did not alert customers of a potential delay.

While the news sparked concerns about the potential impact on Nvidia’s revenue, Business Insider reported the following day that the issues had largely been resolved.

Amidst this backdrop, Nvidia’s Q3 2025 results on Wednesday were eagerly anticipated. Nvidia reported total revenue of US$35.1 billion for Q3, up 17 percent quarter-over-quarter and up 94 percent year-over-year. This was higher than both Nvidia’s own Q3 revenue guidance of US$32.5 billion from its Q2 2025 report and LSEG analysts’ estimates of US$33.1 billion.

Data center revenue came in at US$30.8 billion, up 17 percent from Q2 and up 112 percent from a year ago. GAAP earnings per diluted share were US$0.78, up 16 percent from the previous quarter and 111 percent from a year ago. The consensus estimate for earnings per share was US$0.75.

Despite an objectively positive Q3 performance, Nvidia’s stock price fell in after-hours trading. The company’s Q4 sales forecast of US$37.5 billion, while strong, disappointed investors that projected the first quarter to count sales of its anticipated Blackwell chips to be between US$37.1 billion and US$41 billion.

This lower-than-expected forecast represents the company’s slowest revenue growth projection in seven quarters, even considering Big Tech’s multi-billion dollar spending plans on AI.

Additionally, the company remained silent on whether it anticipates sales of its Hopper chips to increase as Blackwell chips become available. A slowdown in Hopper sales could negatively impact Q4 revenues, particularly if production issues continue.

By Thursday morning it had recovered slightly, opening 2.3 percent above Wednesday’s close and over 7 percent higher than its valuation on Monday. Nvidia ultimately closed the week up 1.84 percent at US$141.95.

5. Super Micro Computer hires new auditor, submits plan of compliance

Shares of Super Micro Computer (NASDAQ:SMCI) jumped on Tuesday after the company revealed it hired a new auditor, BDO USA and submitted a compliance plan to the Nasdaq Exchange (INDEXNASDAQ:.IXIC) with regards to the delayed filing of its reports, Form 10-K for the fiscal year ended June 30, 2024, and Form 10-Q for the period ended September 30, 2024.

Both were delayed due to concerns raised by the company’s former auditor, Ernst & Young, about its financial reporting, governance and internal controls.

Its share price rose to US$27.16 at the opening bell on Tuesday, over 26 percent higher than Monday’s closing price.

Super Micro may be able to extend its deadline for filing the required document until February if the Nasdaq accepts its plan. The company’s listing on the exchange would be maintained during this period until a final decision is reached regarding its compliance. In the event the plan is not approved, Super Micro has the option to appeal the decision.

Its share price was US$33.15 on Friday’s close, up over 65 percent for the week.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.